Plans to double council tax on second homes in York will be discussed by councillors next week.

City of York Council is set to follow in the footsteps of North Yorkshire County Council in introducing a 100 per cent premium on council tax bills for second home owners.

Second home ownership in York was estimated at 429 in 2020/21, according to the National Housing Federation, and is recognised as having a negative impact on local housing supply.

Local authorities look set to be granted the power to apply the premium on second homes which are not let out or lived in for at least 70 days per year under the government’s levelling up bill, which is going through parliament.

Analysis has shown the premium could provide a boost of more than £740,000 to the council’s stretched finances – which would help in delivering crucial local services, including the provision of affordable homes.

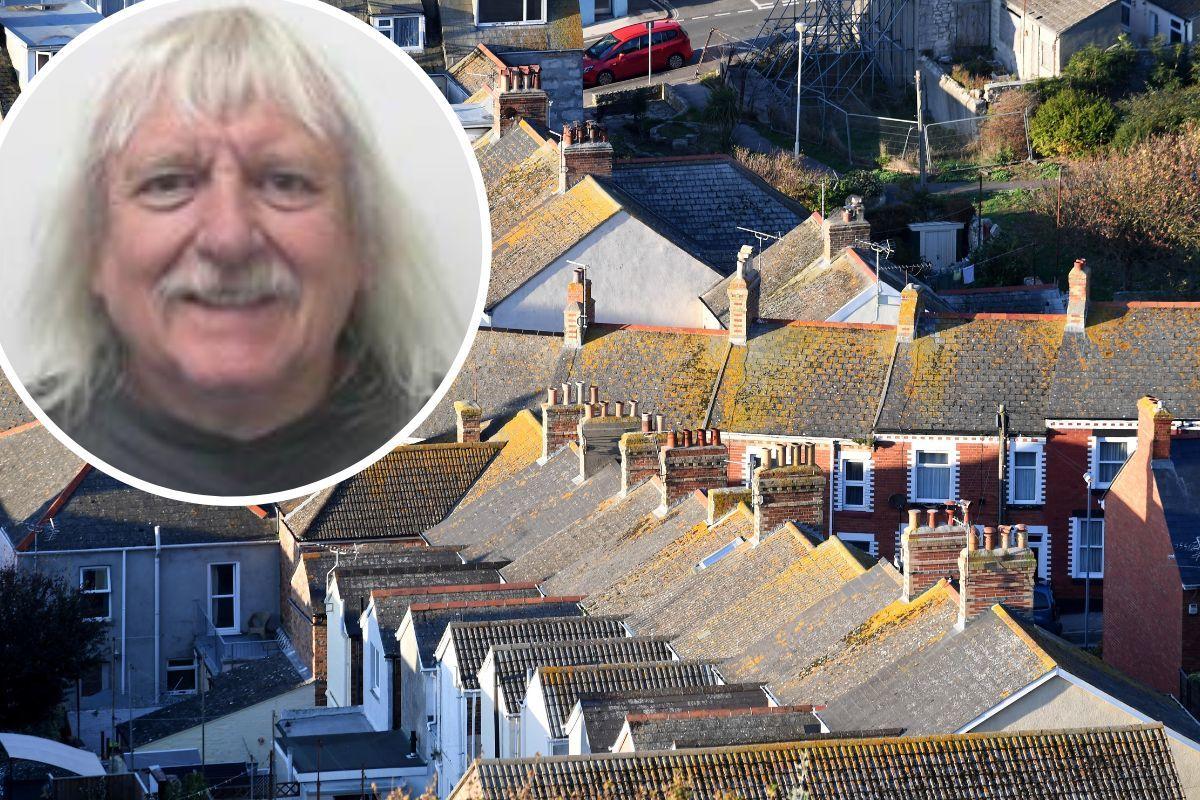

Liberal Democrat councillor Tony Fisher, who has tabled a motion in favour of the move for discussion at full council on Thursday, December 15, said: “Access to affordable housing continues to be a major issue locally, and whilst delivery of affordable homes has ramped up significantly over the last few years, it’s clear that York is not immune to the national housing crisis.

“The considerable number of second homes in the city is undoubtedly adding to the issue, and we’re keen to do everything in our powers to ensure that York has the right mix of homes, so our communities remain sustainable for future generations. “

He added: “The proposals are ultimately aimed at bringing second homes back into use for local communities after many people have been priced out of the housing market in York.”

The average house price in York was £315,202 in June 2022, according to the Land Registry.

Cllr Fisher’s motion also urges the Government to address concerns over any tax avoidance loopholes.

Fears have been raised in North Yorkshire, which voted to double council tax in September, that second home owners will be able to find loopholes in the scheme to avoid paying the premium, such as by classing their properties as holiday lets – which qualify under business rates instead.

The earliest the new council tax premium will take effect is April 2024, if the Government’s proposals do become enshrined in law.

While accurate data can be difficult to come by, council officers in York are working to get the latest information on second home ownership in the city to ensure the measures would be implemented as swiftly as possible.

In 2018, City of York Council introduced a policy of charging an extra 50 per cent in council tax on long-term empty homes – bringing the total to 100 per cent – in an effort to them back into proper use.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel