Nadia Jefferson-Brown checks out the wealth of financial support available to help boost businesses in the region.

Do you have an idea for a business, a start-up ready to take flight or a fully-grown venture that needs to diversify to survive?

Funding providers are poised, ready to support businesses in the region and guide them through the next stage to grow, upskill, create new jobs and prosper.

But where do you start? High street banks are no longer the main source of support, says Keith Humphreys, of York-based Pinpoint Finance. “The day is gone when you go and see your bank manager. The market is so fragmented now with lenders. If a bank says ‘no’ people think that's the offer, but really it is just a ‘no’ from them.”

Stephen Waud, Business Enterprise Fund chief executive, says our region is a good place to start out.

"Known for its diversity, the Yorkshire region is a great place to start or grow a business. It is home to talented people capable of developing word-class products and services across all sectors.

"It is also home to organisations like Business Enterprise Fund that provide business funding and support. Altogether, this means the region's businesses have excellent access to the resources they need to start, grow and impact the communities in which they are located."

Simon Middleton is the business growth manager at Make It York, and offers a free service to advise businesses on funding options and guide them through the application process.

"My focus is to support the existing local businesses and help them develop and grow, which is key to York’s future prosperity," he said.

One of his recent success stories was helping Janice Dunphy, of The Web Adventure Park in York, to secure a Rural Development Programme for England Grant to support her plans for expansion. The investment, along with a loan from HSBC and personal funds, paid for a new sensory area and an improved food and drinks servery, and will help fund plans to redecorate the site and create a new laser tag zone on a mezzanine floor.

Janice said Simon's support had been invaluable. “I told him what I wanted to do and asked ‘what help can you find for us?’ Simon did the research for the grant, came up with a few options and supported us all the way. Without him, we wouldn’t have known we could actually get it. He was intrinsic to us finding the grant and giving us the confidence to do it."

Simon explained: "I spend all my time talking to businesses about the wide range of grants."The target market for us is any business that wants to grow. These businesses will attract grants. I want people to come and have a conversation with me, first and foremost. Then I worry about the eligibility criteria. It hasn't cost Janice anything, apart from her time, to get this grant."

Looking for funding support? Here's a taster of what's available:

Got an idea for a product? Check out PAPI (Product and Process Innovation) papi.org.uk

Small and medium enterprise (SME) businesses are being invited to tap into £1.25 million of grant funding from PAPI (Product and Process Innovation), which is delivered by the University of York and supports the creation of new products. PAPI provides a grant of 40 per cent (between £8k and £20k) for equipment on a project spend of between £20k and £50k. PAPI is part-funded by the European Regional Development Fund and has provided more than £1 million to support 68 businesses, created 130 jobs and 100 products since 2016. It will now run until 2022. PAPI offers support to help develop funding proposals, and guidance throughout the application process.

Chris Jaume and Dr Abbie Neilson set up Cooper King Distillery, near York, and launched Cooper King Dry Gin, in May 2018. The PAPI project provided support to purchase initial equipment including a copper pot still and gin distillation equipment. Chris said: "We have been able to enter the market place and develop new products at a much faster rate than would otherwise have been the case with the first aged whisky product likely to follow in 2023.”

Cooper King have since won contracts and industry awards, and continue to grow. They have implemented a sustainability plan which includes running their distillery on 100 per cent green energy, offering a gin refill scheme and using plastic-free packaging.

Firefighters, Matthew Sygrove and Joe Barratt, founded Simply Breathe in 2012 to design and make compressed air products.

They wanted to bring a product to market which could supply oxygen in emergency situations, such as house fires. Initially, they were fulfilling orders by hand; they needed a gas filling line to meet increased demand but it was financially beyond their means. The business, in Beverley, East Yorkshire, received a £20,000 grant from the PAPI project which enabled them to purchase a processing line, develop new products and increase production.

Products now include Recreational Oxygen, for use by athletes and in high altitude activities, and Gas Horn which operates at 120 decibels to alert people in noisy environments to emergency situations.

“The grant came just at the right time as there were orders we would have had to turn down," says Joe. "The increased efficiency of manufacture means we have more time for innovation and winning new business.”

Starting out or growing your business? Check out Business Enterprise Fund (BEF) befund.org

The BEF supports businesses which are making positive changes within their communities, and offers grants from £500 to £250,000, including short-term loans.

England’s first commercial seaweed farm, in the North Sea off Scarborough, received a £25,000 BEF loan.

Former fisherman, Navy diver and navigating officer Wave Crookes, and marine scientist Laura Robinson set up SeaGrown and initially harvested seaweed from rocks to create products for food, baths, pets and restaurants. They then ventured into seaweed farming with support from the Coastal Communities Fund to sustainably increase production levels and expand into bigger industries such as biochemicals, food additives, biofuels and plastics.

Wave said: “Seaweed has many phenomenal qualities, including soaking up of carbon, oxygenating and de-acidifying seawater, its ability to create biodegradable plastic and cut down ruminant animal methane emissions by up to 80 per cent. All it requires is sea and sun to grow, so sustainability is at the heart of our business.

“The funding from BEF has enabled us to purchase the equipment which is fundamental for us to start processing the seaweed."

Looking to grow? Try the Manufacturing Growth Programme for size. manufacturingrowthprogramme.co.uk

The Manufacturing Growth Programme (MGP) is for small to medium-sized manufacturers who want to grow, increase competitiveness and improve productivity. Funded by the European Regional Development Fund (ERDF) and delivered by Economic Growth Solutions (part of Oxford Innovation), it has been extended until September 2021. A business diagnostic and action plan is provided, with grants from £1000. Workshops will also be available until March 2022 to address skills needs.

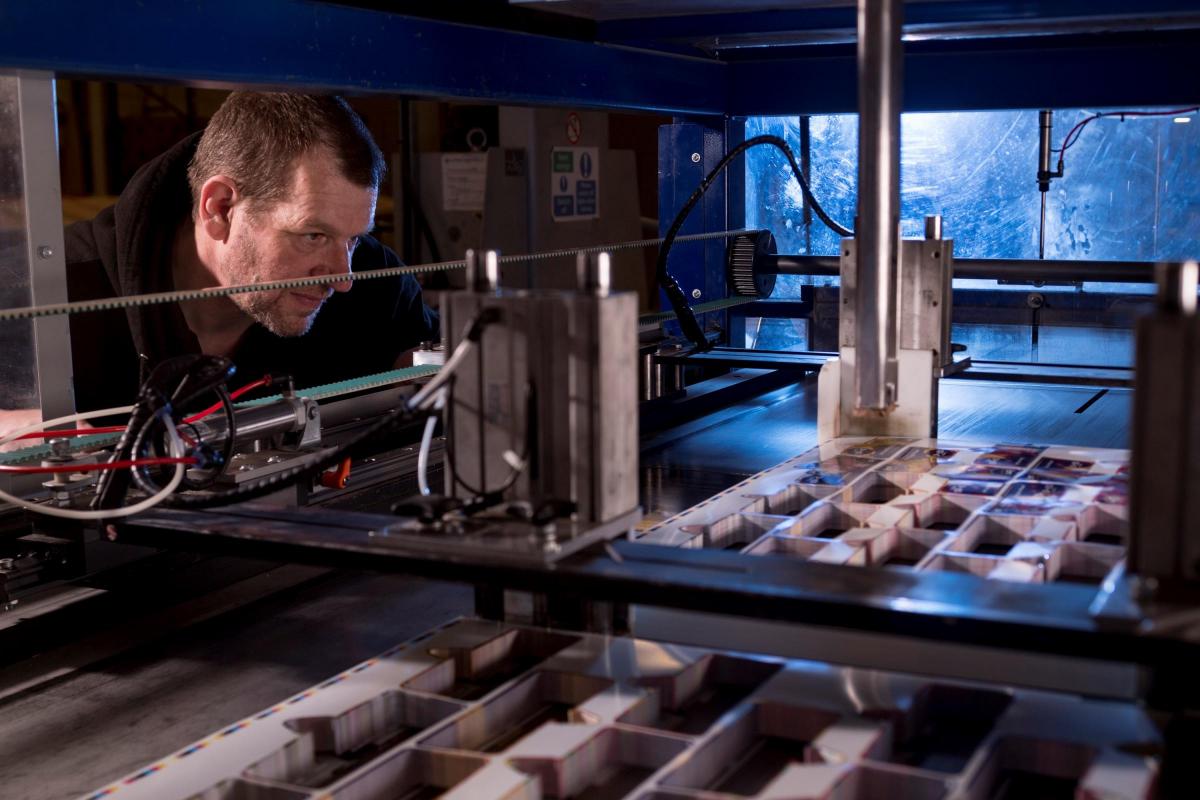

Family-run Ryedale Printing Works Ltd at Kirkbymoorside is a specialist printer, using state-of-the-art production techniques and employing more than 70 people. Before engaging with the MGP, Ryedale had plans to grow but concerns that its processes, which are stretched during busier periods, would struggle.

Alongside MGP, the business identified a need to address bottlenecks in its studio department by digitising its processes and enabling customer engagement through a new IT system and portal. James Buffoni, managing director, said: “We are in a niche market and have a lot of ideas on how to digitalise, automate and streamline our business and to retrain our teams as we move forward.”

Ambitious plans? Check out HSBC UK’s national SME Fund business.hsbc.uk/en-gb/corporate/gb/campaign/fund-for-smes

HSBC UK’s national SME Fund aims to help businesses realise growth ambitions.

Neil and Jeanette Pearson used a flexible business loan from HSBC UK to purchase Ruswarp Pleasure Boats near their Chainbridge Riverside Retreat on the River Esk at Ruswarp, near Whitby.

They wanted to expand their leisure operation which includes holiday cottages, a miniature railway and cafe at the Retreat. The pleasure boat company offers 17 rowing boats, 18 kayaks and a boat launch, as well as a freehold building.

David Slane, business banking area director in the North East, HSBC UK, said: “The region is home to a buoyant leisure sector and HSBC UK is dedicated to supporting ambitious businesses in the region.”

Development plans? Consider The Northern Powerhouse Investment Fund (NPIF) npif.co.uk

The NPIF invests in micro-finance, business loans and equity finance sub-funds which will offer financing, from £25,000 to £2 million, to help businesses secure funding for growth and development.

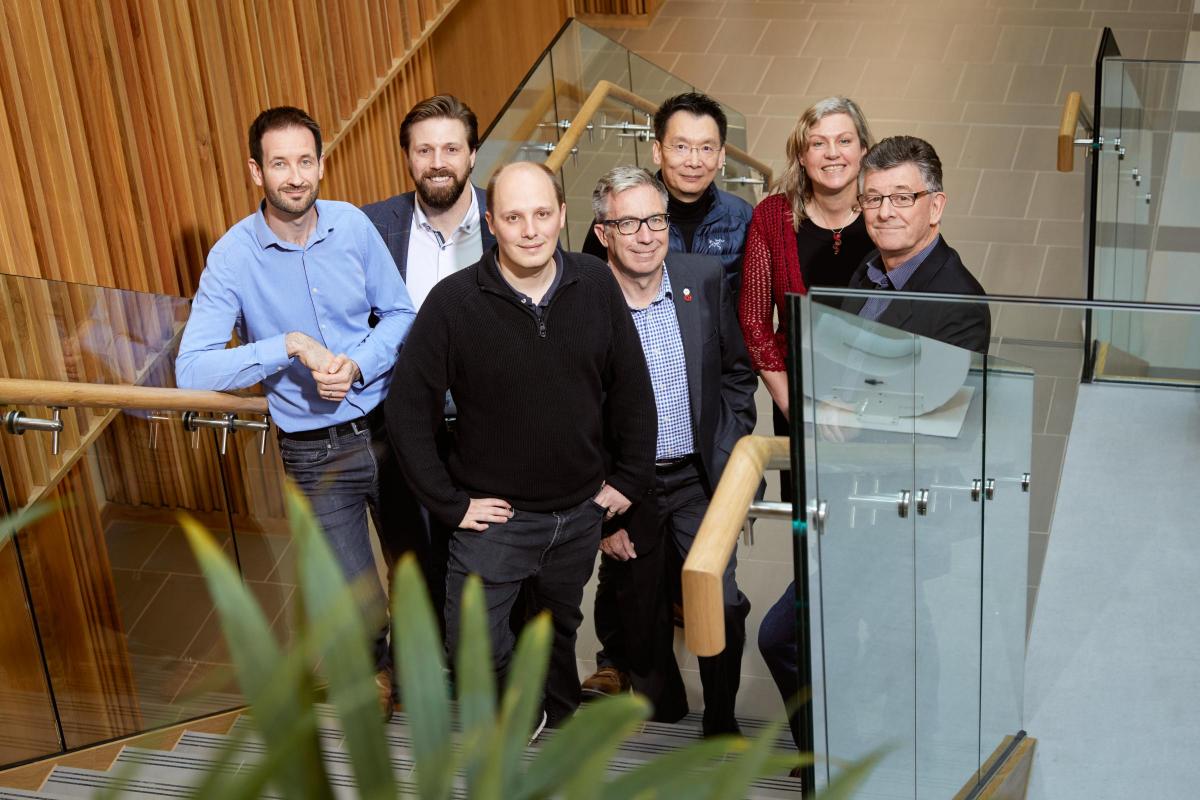

University spin-out Slingshot Simulations secured £750,000 from the University of Leeds and NPIF – Mercia Equity Finance, which is managed by Mercia and is part of the NPIF, to develop its technology and break into new markets.

Based at the University of Leeds’ Nexus innovation hub, Slingshot was established to commercialise seven years of research by computer scientists at the university. It uses advanced simulation technology to help businesses devise more efficient ways of working. Organisations can use the platform to build a ‘synthetic’ world that mirrors their own operations to test ideas and inform decisions. Mark Wilcockson, at British Business Bank, said: “Since its launch in 2017, NPIF’s impact on new and scaling businesses has been wide ranging, providing funding to launch new products, employ new staff, enter new markets and acquire new facilities. In addition to helping these SMEs, it is also important for us to tap into the academic resource available and strengthen industry collaboration, so this investment is a particularly exciting one.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here